Would You Buy Shares in Your Favorite Musician?

The next stage of music tokenization might look very strange

Faced with declining income from recordings and touring, musicians have been forced to find alternative sources of income. The article below examines some of the stranger ways this might play out in the near future.

In the middle of the week, I’ll share an in-depth look at jazz pianist Erroll Garner, to celebrate his hundredth birthday, for paid subscribers to The Honest Broker. Time permitting, I hope to publish a more unusual historical post that will be sent to all subscribers, free and paid, at the end of week.

The Honest Broker is a reader-supported newsletter. Both free and paid subscriptions are available. Those who want to support my work are encouraged to take out a paid subscription.

Would You Buy Shares in Your Favorite Musician?

By Ted Gioia

At first glance, the recent craze for non-fungible tokens (NFTs) looks like a gimmick—and perhaps it really is just a passing fad. Frankly, I’ve been the first to laugh at the incongruity of treating digital images and music—the ultimate realization of Walter Benjamin’s dream of easily accessed, reproducible art—as though they’re unique collectors’ items.

It’s tempting to dismiss this marketplace as one more asset bubble in a time of excess financial liquidity, with market prices driven by vanity and hype. Under this scenario, music NFTs are like Pet Rocks, only with a different kind of rock as pet—and potentially just as ephemeral in their cultural impact. For the record, the Pet Rock market lasted roughly six months before collapsing. (By comparison, the first music album NFT was issued only 100 days ago.)

That said, I don’t expect NFTs to go away. Put bluntly, vanity is at least as old as King Solomon, if not older—and won’t disappear anytime soon. And even in the 21st century, the vainglorious fill up the front row seats at every Sotheby’s auction. The real question is how much the NFT market can gratify the collector’s eternal desire for aggrandizement. Even something as simple as attaching the name of the NFT owner to the Wikipedia and Discogs page for an album would enhance exchange value for a NFT.

“One day you own shares in the Beatles, and after the band dissolves, you still control those tokens, but now receive (in a tax-free spinoff) rights to John, Paul, George and Ringo.”

The biggest disadvantage—and I’m surprised I haven’t heard anyone mention this—is that you can’t list the name of the NFT owner on the actual physical album. Why not, you ask? Well, because the NFT will be bought and sold like any other ‘original’ work of art, so unlike, say, the executive producer, the owner’s name will change over time. The musicians on Kind of Blue , by comparison, are set in stone, permanent as the faces on Mt. Rushmore, and the same is true of everyone else on the album credits. But NFT owners come and go—quite unlike Michelangelo.

And how frustrating if you’re Jeff Bezos, and you’ve just bought the NFT for your favorite Journey album, but still see Martin Shkreli or Bill Gates’s name listed on the vinyl album back cover. I hate to say it, but solving this problem in ego gratification will be a key step in legitimizing music NFTs. My verdict: NFTs for music won’t really take off until (1) income streams are attached to the token, or (2) the owner’s name is commemorated (and displayed prominently) in a sufficiently elitist master-of-the-world manner.

Here’s a free business idea for you: Start a universal registry of NFT music owners’ names, preserved for eternity on blockchain, but updated with each change of ownership—and give free shares to record labels and star musicians who sign up as participants. The musicians and labels still retain all their intellectual property rights, but you’ve given them some sizzle to sell along with their stakes. And each of them receives partial ownership in the registry business for free, just by joining—so their participation is a no-brainer. It’s like the “name a star” registry, but with the kinds of stars that really matter.

Not only is the NFT owner recognized on this proposed blockchain, but the entire lineage, including every previous owner—traced back to original seller (or recording artist)—is preserved as well. Now Jeff Bezos can point proudly to an entire family tree tracing his ownership in Kind of Blue back to Miles Davis himself. That’s an NFT proposition to make billionaires salivate like Pavlovian poodles in a belfry.

But this is all child’s play compared to the biggest tokenization move of them all. Why buy a picture or a song, when you can actually own the musician? The notion isn’t as far-fetched as it sounds—patrons have wanted this since the beginning of time ( and already online marketplaces are laying the groundwork for this ultimate tokenization). The so-called “360 deals” in the music business are only a step away from this holistic control and command concept. The end point is clear, if vaguely disturbing: turning the entire artist into a saleable commodity.

I can already see you cringing at the idea. Yet artists have been selling ownership stakes in their works for ages, and many of these deals represent almost total subservience to the highest bidder. It’s worth recalling that Haydn was forced to sign away all intellectual property rights for every composition to his patron, And even today, tokenization isn’t much different from what happens behind the scenes at Broadway shows, New York gallery openings, and a hundred other cultural enterprises. So why not sell the whole package: copyrights, masters, rights to future works, branding, side deals, the whole kit and the entire caboodle?

Consider it like artists’ estates, except they’re still alive and can cash out while able to enjoy the money. And it might be very profitable for the investors too. I recall a family friend telling me when I was in high school that he would pay my way to college in exchange for a share of all future earnings. He was just joking, but at that time the cost of college seemed dauntingly high—although nothing compared to what it is now—and I recall how charmed I was by the idea of trading future income against present need. Given an actual opportunity, I might have signed on the dotted line—the ultimate payday loan.

The notion of selling shares in an artist in band raises many intriguing possibilities—too many to deal with here. But let me list some of them.

A band could sell shares in its music, with potential for spinning off ownership of individual musicians as separate tokens in the case of a breakup. One day you own shares in the Beatles, and after the band dissolves, you still control those tokens, but now receive (in a tax-free spinoff) rights to John, Paul, George and Ringo.

Artists could do mergers. So Beyoncé and Jay Z decide one day to issue a combined token. They both enjoy some diversification benefits, and help cement their relationship at the same time.

Artists would be free to issue new shares, provided the cash or benefits received are shared equably among current owners. The end result would be like different stages in venture capital financing. I can already imagine the conversations on Sand Hill Road: “Hey, our firm got into Olivia Rodrigo in the first round, for ten cents a token—and we’re now issuing new tokens at two bucks.”

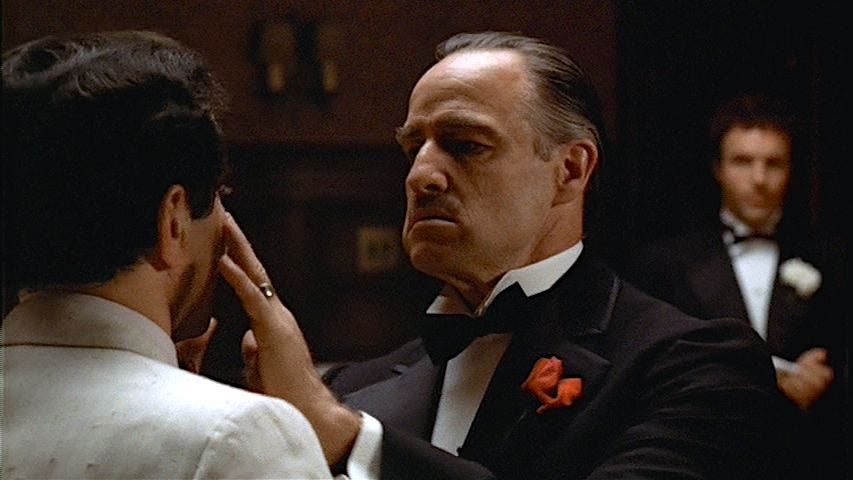

When artists run into career problems, they could turn to their powerful billionaire owners for help in resolving them. Consider it as the digital age equivalent of Johnny Fontaine in The Godfather, who gets Don Corleone to make an “offer that can’t be refused” to a stubborn movie mogul. In fact, the whole relationship between Frank Sinatra and the Mafia might be considered as a prototype for the artist tokenization business.

Fans would have endless opportunities for demonstrating their loyalty. In the old days, they could buy every album by a favored artist, but in a tokenized world the bar is raised considerably. Even accumulating, say, a 1% stake in second-tier musician might take years of scrimping and saving.

Artists would face the complex financial trade-offs all corporations need to address. Do they give away earnings as dividends to token holders, or invest the money in future projects? The older the musician, the greater the pressure to distribute the profits.

There are many other ramifications of this envisioned shift to tokenization. But the biggest challenge will be how government regulators deal with this business opportunity. Financial securities are among the most heavily regulated assets in the world. The more the story of the artist resembles a young start-up, the greater the likelihood of government intervention. By comparison, owning a painting is simple. Already, many digital token businesses have run afoul of the law.

My hunch is that politicians will find this whole concept of buying and selling artists rather distasteful. But I have no doubt that they will overcome their qualms and scruples if they can tax it and extract other personal benefits (lobbyist perks, kickbacks, campaign donations, etc.).

And if the SEC gets too stubborn, Olivia Rodrigo will simply list on, say, the Toronto or Korean token exchange, bypassing the US entirely. Companies have long sought listings on less regulated stock exchanges to sell risky securities, so why can’t the same happen for band tokens too? Music is already a global business, and the one thing we’ve learned about blockchains, is that you can make them illegal, but they never really go away. They live on hard drives, and those are everywhere.

So artists might get tokenized no matter what regulators decide. And if you think stock trading on the Robin Hood app got out-of-control, just wait until you see teens buying and selling tokens of hot rappers and boy bands and sultry divas. And, yes, I’m apprehensive about the whole shebang. . . but it would be nice to see young folks spending money on music again.

Splendidly cynical, and terrifyingly attractive.

Future's bright. Also we are going to need all the AI help we can get to model and then negotiate these complex deals and navigate these markets.