The Netflix and CNN+ Disaster—and What's Next for Subscription Streaming

A few weeks ago, I published an article under the provocative headline “Why Netflix Will Falter.”

I laid out my skepticism about the company’s strategy—especially it’s desire to operate as a stand-alone closed system built on proprietary movies and TV series. In my article, I showed how closed systems of this sort have failed in the past, even when built by huge, powerful companies. And they always fail for the same reason: consumers prefer open, flexible systems.

I won’t summarize the article here, if you want you can read it yourself. But I will quote from the final paragraph, where I said I couldn’t predict when Netflix would falter, but that “it might not be all that long before we see the first cracks in the empire.”

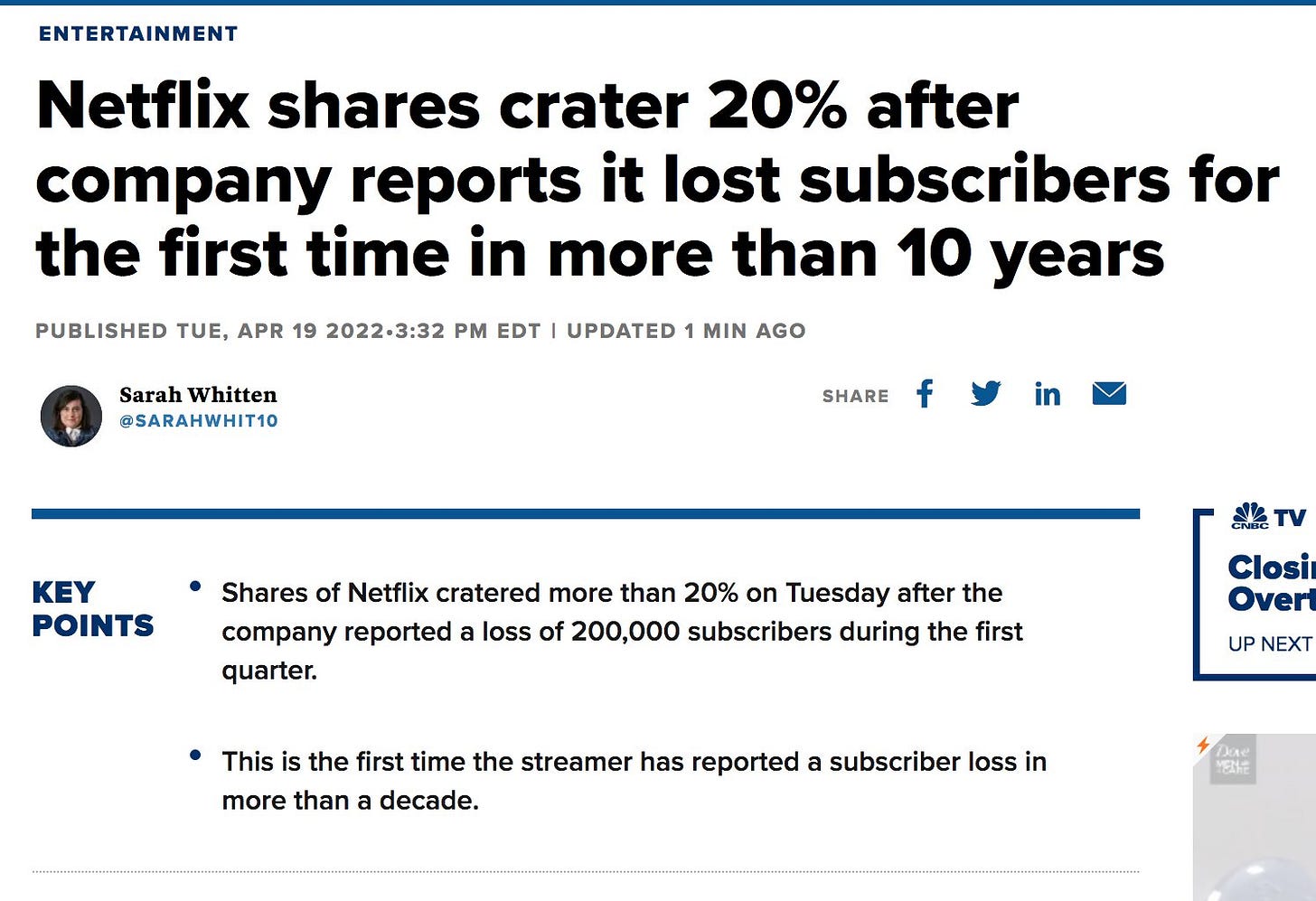

Yet even I was surprised to see how fast the downturn came. Here’s a news headline from Tuesday:

In fact, that headline understates the problem. Netflix’s share price is now down almost 40% from where it was just a few days ago. The company’s market capitalization has dropped a staggering $150 billion from its peak. That’s more than the entire GDP of Ukraine—and it disappeared without a bullet fired or bomb dropped.

The Honest Broker is a reader-supported guide to music, books, and culture. Both free and paid subscriptions are available. If you want to support my work, the best way is by taking out a paid subscription.

A famous hedge fund manager named Bill Ackman took a $400 million loss, after only being a Netflix shareholder for three months—which caused much glee in some circles.

This was then:

And this is now:

In a letter to shareholders, Netflix struggled to explain the bad news, and also made some dismal predictions for the future. They said they expect a continued reduction in subscribers—extraordinary for a company that doesn’t pay a dividend, and tells shareholders that they will get returns instead from growth.

Of course, the reason Netflix doesn’t pay a dividend is because it doesn’t generate much cash. The company has borrowed heavily to cover the costs of all those new movies and TV series, and thus carries a debt load of almost $15 billion. This is very different from its competitors—take Apple, for example, which has raised its dividend and bought back $90 billion in stock, and still has $200 billion in cash in its bank accounts.

If Netflix hadn’t decided to go to war against all of Hollywood, they might not have needed to borrow all those billions. But you won’t read that in the company’s press release. Instead Netflix blames its poor financial performance on four problems—each of them beyond their control. It’s not our fault, they insist, it’s everybody except us.

These are the four problems, according to Netflix

The uptake of connected TVs: According to Netflix, most of their audience watches Netflix on television sets—and the pace at which people purchase and plug in those TVs is, they claim, a factor “we don’t directly control.”

Password sharing: It’s the cheating customers, not us.

Too many competitors: How can they be blamed for what Disney and YouTube are doing? Let alone Hulu, Apple, Paramount, the Criterion Collection, etc.

Macro factors: It’s the economy, stupid. And that war. If it wasn’t for Putin, everyone would be watching Bad Vegan.

You can see that this company is still in deep denial.

They are still in the first stage of the Kübler-Ross model—not a happy place. Or if Netflix were in a 12-step recovery program, they haven’t even mastered step one. And it won’t get better until they admit that their own actions have put them in this situation.

Netflix began as a distributor of entertainment, but they evolved into a competitor to their previous suppliers—and, at a final stage, they embarked on a scorched earth strategy. They are now sworn enemies to Disney, Paramount, HBO, and countless other companies that, under different circumstances, might be partners. The end result is an over-crowded field, where everyone in media and entertainment wants to launch a standalone subscription service.

The problem with this strategy was made clear just a few hours after the Netflix fiasco. The CEO of Warner Bros. Discovery announced the shutdown of another failed streaming subscription service, namely CNN+—which had launched only a month earlier.

But here the announcement was much more honest. This is what the CEO said:

"In a complex streaming market, consumers want simplicity and an all-in service which provides a better experience and more value than stand-alone offerings.”

That’s short, simple, and totally accurate.

As you will recall, that was also the point of my earlier article “Why Netflix Will Falter.” Hey, it’s even possible that the CEO read my article.

In any event, the evidence here is clear and unambiguous: Consumers want open and flexible platforms, not closed, proprietary systems. We’ve seen that trend play out in dozens of industries—from credit cards to video games. Netflix’s desire to operate in its own fortress, without the support of legacy studios—in fact, treating them collectively as the Evil Empire—has not only limited them to homemade programming, but forced these other players to create their own stand-alone platforms in response, which now crowd the market.

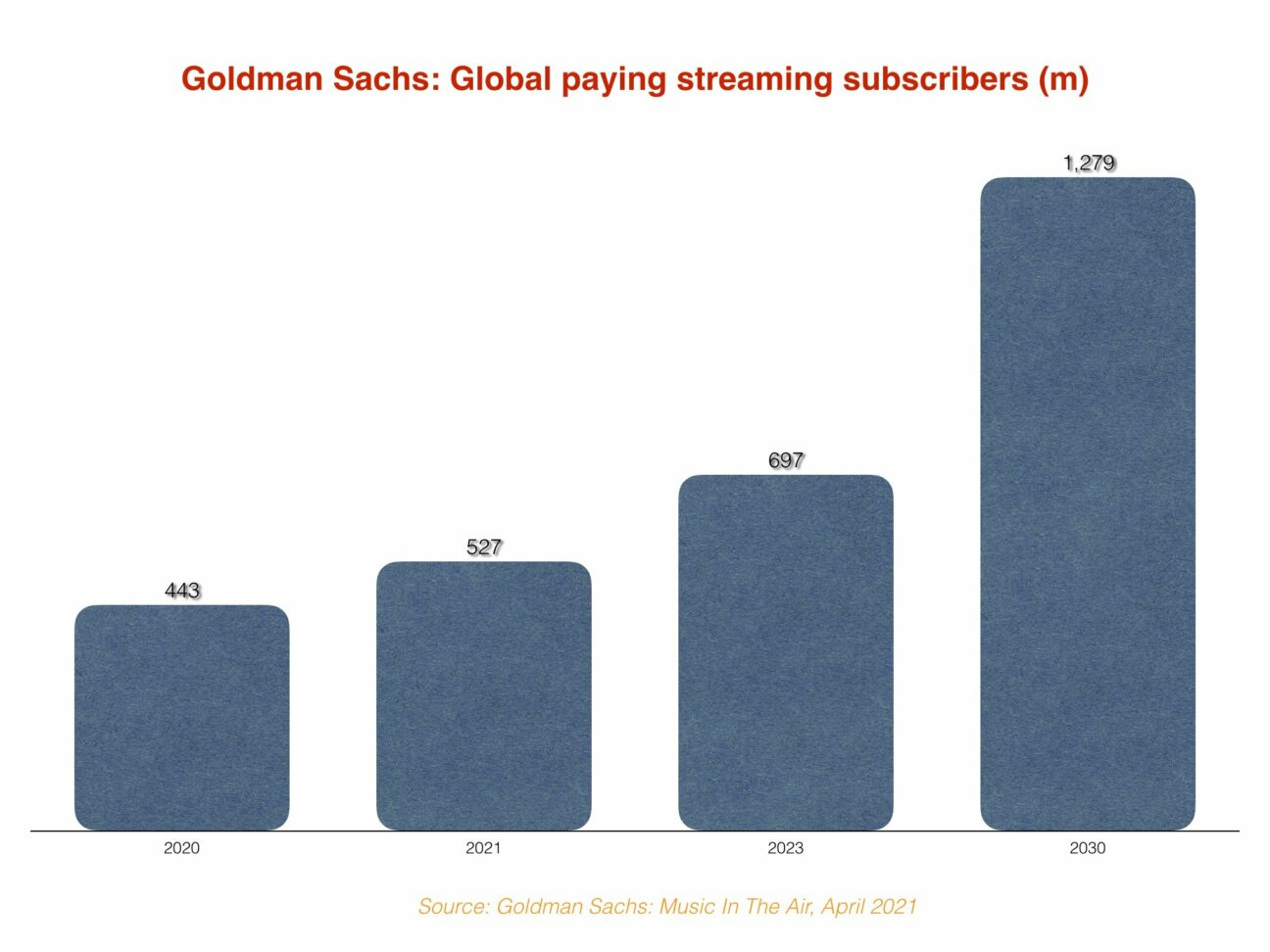

This has clear implications for music too. Spotify is relying on continued subscriber growth, just like Netflix. But that’s a bigger challenge than it was a few years ago. Just consider the projections Goldman Sachs shared last year. How realistic are these forecasts for music streaming subscriptions, based on what we’ve seen in the last few days?

Here’s a headline from a February—not long after Goldman Sachs shared these optimistic projections.

We are definitely seeing a pattern, no?

And that leads to the third news story this week—when Spotify declined to make an offer to renew their exclusive deal with Barack and Michelle Obama. The media reports failed to underline the two most important details of this development—namely that (1) the Obamas want to embrace an open, multi-platform approach, and (2) Spotify didn’t even feel capable of making an offer to retain exclusivity.

This is the exact same situation faced by Netflix and CNN+. The media world will not evolve into standalone fortresses. Maybe companies want this—it’s human nature to desire total control over your environment—but consumers will fight them at every step.

I stand by my prediction that this war will eventually be won by open platforms and competitors who are willing to work together. At the current moment, Amazon still seems to me the most likely victor—if only because it is the most willing to stream competitors’ offerings (although sometimes at a surcharge) to Prime Video customers. I mentioned that in my earlier article, and I’m not surprised that Amazon has been named as a possible new home for the Obama podcasts.

But another party might come to the forefront in the streaming wars, even a completely new one—perhaps the result of a merger or joint venture between existing players.

The exact details can’t be predicted. But I will tell you that Netflix’s problems aren’t going away—especially because they haven’t begun to take on responsibility for them. And other companies that are imitating them will encounter similar obstacles. The forthcoming Disney quarterly report might be an early indicator.

...and I repeat the comment I made about "Why Netflix Will Falter" at the time: Most homemade Netflix content is substandard.

When your programming openly mocks half the nation, that would also seem to constrain growth opportunities.