The Bubble Just Burst

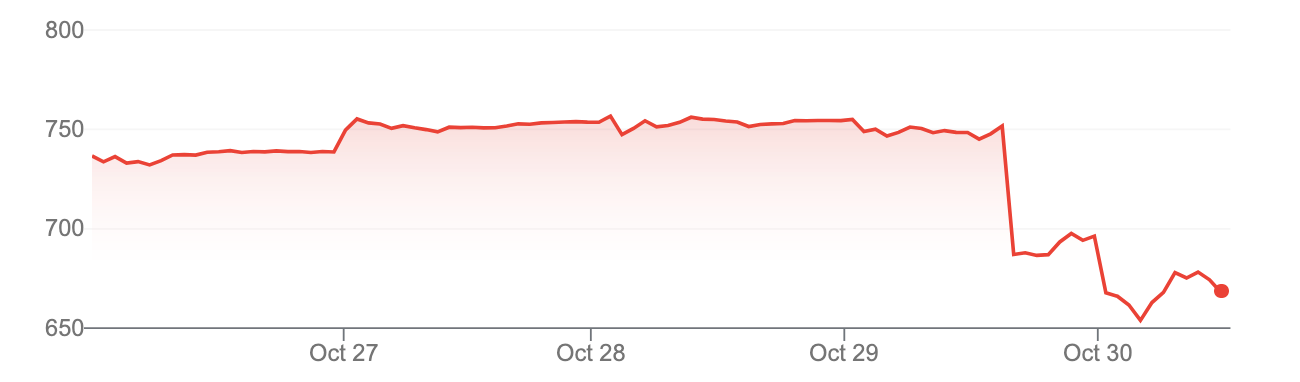

Mark Zuckerberg had exciting news to share yesterday. His company Meta had finished a great quarter—and would continue to increase spending on AI.

He said that yesterday afternoon. But when the market opened this morning, Meta shares dropped more than $80. That’s $200 billion in market cap wiped out in an instant.

Why don’t investors like AI? Only a few months ago, companies saw their shares skyrocket when they made AI investments.

Please support my work by taking out a premium subscription (just $6 per month—or less).

In September, Oracle’s stock shot up 36% in just one day after announcing a huge deal with OpenAI. The share price increase was enough to make the company’s founder Larry Ellison the richest man in the world.

But then investors changed their mind. Since that big day, Oracle shares have fallen $60. Larry Ellison is no longer the richest man in the world.

This is the sound of a bubble popping.

Keep reading with a 7-day free trial

Subscribe to The Honest Broker to keep reading this post and get 7 days of free access to the full post archives.