Subscription Prices Gone Wild!

Can they really get away with this?

It’s not every day that I get an email from Apple. But yesterday the Cupertino leviathan reached out to me.

Can you guess why? Do they have some cool new gadget that will make my life better? Are they opening an Apple Store in my neighborhood? Does Tim Cook want to take me out to dinner?

None of the above. Apple is raising my subscription price for Apple TV by a whopping 30%.

Apple is not alone. The very next day, Disney announced a similar move.

This is the fourth straight year that Disney+ has forced a price increase on viewers. The ad-free subscription price has almost tripled in just six years. During that same period, Disney’s movies have gone from bad to worse—but you pay more to stream them.

The company is truly tapping into its inner Scrooge McDuck. Inflation is just 3% now (according to official, if somewhat dubious, sources). But the ad-free subscription to Disney+ was jacked up 14% last year and is now getting another 19% boost.

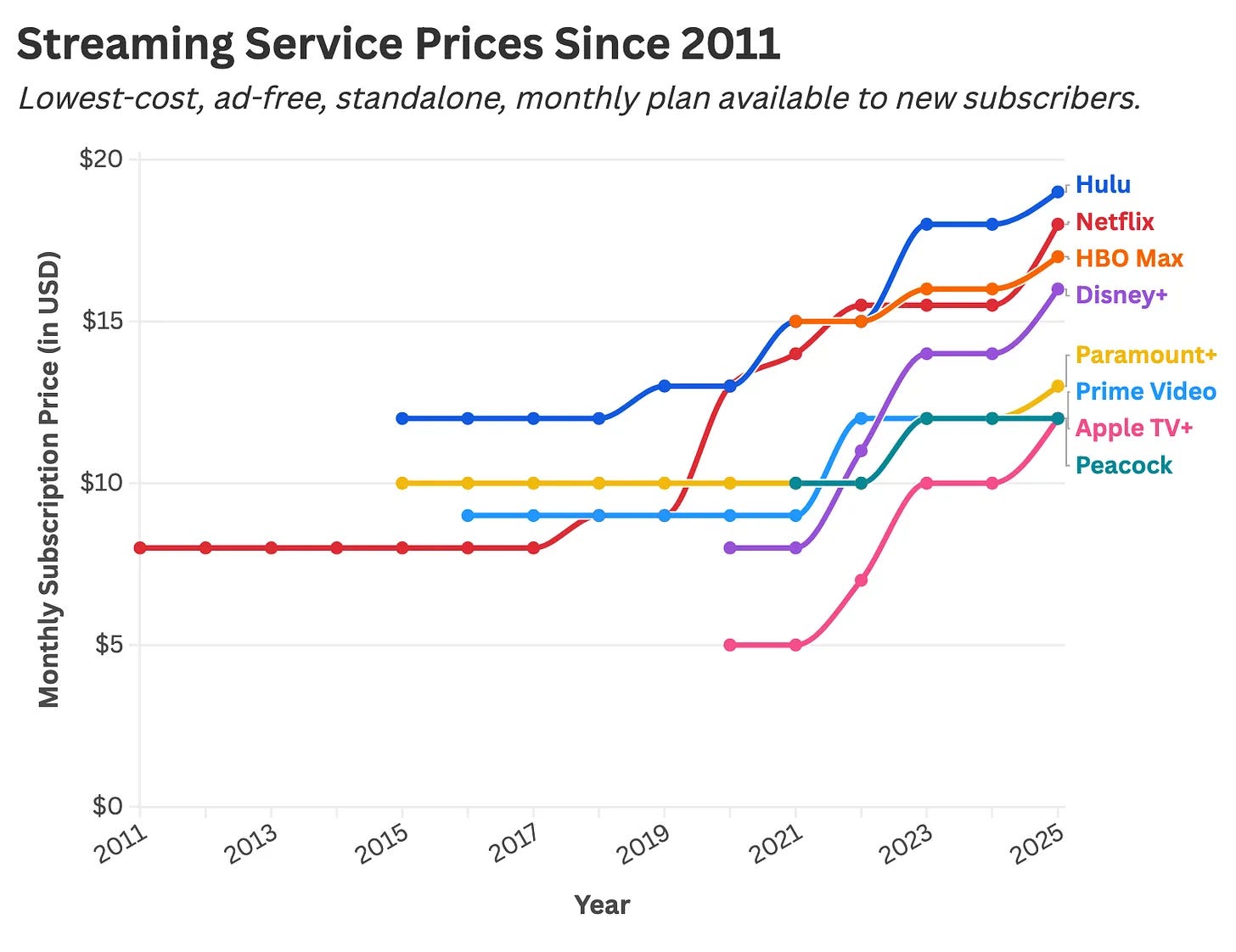

Take a look at the larger picture, via this chart from Daniel Parris of Stat Significant (a friend of The Honest Broker). This stuff is reaching greed-is-good levels of abuse.

Meanwhile, the number of scripted shows commissioned by these streamers has dropped significantly. So the audience is asked to pay more for less.

This is a good point to remind you that subscription price at The Honest Broker has never gone up. In fact, it’s lower now than it was four years ago. You should consider becoming a premium member….

If you want to support my work, take out a premium subscription (just $6 per month).

But we’re outliers here on Substack. Most platform subscription price are going up, not down—and many are skyrocketing.

Music streaming is one more example. Spotify’s Chief Business Officer recently offered the bland observation that price hikes are “part of our toolbox now”—and added “we’ll do it when it makes sense.”

What does that really mean?

According to a recent report from Goldman Sachs, Spotify subscribers should expect regular prices increases from Spotify in the future—with a boost coming every 12-24 months.

Spotify even bragged to the investment community that it’s always planning a price boost somewhere. Here again is the Chief Business Officer laying it out for us:

I want to also remind you that we take a portfolio approach. So in a sense, you could say that we raise all the time. For instance, in the last quarter we raised in France, Belgium, the Netherlands, and Luxembourg. And I can report to you that on churn, we didn’t see anything out of the ordinary for Spotify.

Years ago, I claimed that streaming economics were broken, and price increases were inevitable. But I never anticipated the rapacious response of the suits in the C-suite.

The short explanation is that they do it because they can. Sure, some people cancel their subscriptions, but not enough to make a difference. Most subscribers simply put up with it.

That’s why the streamers keep boosting prices again and again. They will continue doing it until they encounter serious resistance—and they haven’t hit it yet. So I expect more of the same.

But there’s a danger to this business strategy. Look at Las Vegas, where tourism is collapsing because the casinos went too far. For a long time, the public didn’t flinch in the face of price hikes, but then it got ridiculous:

$95 ATM fees

$14 coffee

$50 early check-in fees

$30 cocktails

The casinos have now earned a reputation as exploitative price-gougers. Tourism is now down sharply—hotel occupancy has dropped 15%. The city feels “eerily empty.”

This isn’t easy to fix. Once you destroy your reputation and lose the customer’s trust, it’s almost impossible to get it back. That happened in an earlier day to Sears and K-Mart, and they never recovered.

Something similar may already be happening at Disney’s theme parks. Some visitors report that Disney World is empty—looking like a ghost town even during Labor Day weekend.

They squeezed customers too many times, without increasing value. And Disney is now trying to do the same thing with streaming. Let’s see how it plays out.

The streamers are following a very simple strategy: (1) Raise prices and (2) Cut costs. You might notice that improving quality and reputation are not part of this equation.

In business strategy this is known as an endgame maneuver. It works in the short run, and is smart if you’re running a dying or declining company. Squeeze all the cash out of it that you can, before everything collapses.

This is also a popular strategy with private equity funds. They specialize in acquiring wounded businesses, and making these same moves.

But when prestige companies like Apple and Disney act this way, you really need to scratch your head. Why are these (once) respected businesses treating their own brands the same way a private equity firm deals with a declining industry?

These companies were once focused on innovation and rewarding customers. That could happen again, but not under the current leadership.

Until that leadership changes, expect to see more price increases. And if you want to stop it, don’t complain—just cancel.

And if you’re totally fed up with streaming costs, consider switching to books. I hear they offer a sweet deal on them down at the public library.

The subscription game is out of control. The yearly SQUEEZE on the consumer is way out of line. Was talking to my wife recently, and we are strongly considering keeping the WiFi and just using the “free” channels that are available.

It’s ridiculous.

However, it’s also another firm reminder that we should spend more time reading and less time watching TV. 💯

Keep writing. Nice piece.

Speaking of libraries, Kanopy is a great (and free!) app for movies and shows. Libby is good for magazines as well.