Is the Bubble Bursting?

I'm making this previously paywalled article available to everybody

I’m removing the paywall from the article below. I shared it with premium subscribers four weeks ago—and it’s been a very turbulent month due to the very reasons outlined in the article.

For a start, the stock market is down sharply—despite Fed chair Jerome Powell’s promise to cut interest rates. But the bubble companies highlighted in the article have been especially hard hit. Nvidia is down 15 points. Microsoft is down 20 points. Meta is down 30 points.

The shift in psychology is more marked. Even Open AI boss Sam Altman is now talking about an AI bubble. Of course, he knows better than anyone because he is seeing it up close—the disappointing release of ChatGPT-5 played a key role in setting off the current turmoil.

It’s now clear that recent events have made this analysis more timely than it was a month ago. So I’m making it available to all parties.

If you want to read these frank assessments in the future, consider taking out a premium subscription to The Honest Broker.

Please support my work by taking out a premium subscription (just $6 per month—or less).

Is This What a Bubble Looks Like at the Top?

By Ted Gioia

How can you tell if a tech bubble is about to burst?

Consider this recent conversation between Mark Zuckerberg and Mark Chen, chief researcher at OpenAI—as reported by the Wall Street Journal:

Zuckerberg asked Chen if he would consider joining Meta—and what it would take to bring him aboard.

A couple hundred million dollars? A billion?

A billion dollars to hire one person? Is that even conceivable? Was Zuckerberg just joking?

Not at all—Mark Zuckerberg may be a bit clownish, but he’s no comedian. Consider this other news tidbit from the WSJ:

Zuckerberg settled on Alexandr Wang to lead the new lab. To get him, Meta paid $14 billion for a stake in Scale AI, the data-labeling startup founded by the 28-year-old entrepreneur.

You might respond that Zuckerberg got more than just one person for his $14 billion expenditure. He also gained an entire company. But—here’s the punchline: the company he bought for $14 billion is losing money.

According to Business Insider, Scale AI just laid of 14% of its workforce because it’s unprofitable.

But who’s counting? In this new environment, salaries and signing bonuses get tossed around like Monopoly money. The only difference is that $200 doesn’t cut it any more—you need to pay hundreds of millions to hire the top talent.

Meanwhile in the real world, McDonald’s CFO told Bloomberg that the company is struggling because many customers are now too poor to afford breakfast.

And this isn’t some isolated anecdote—it’s a data-driven report from the biggest restaurant chain in the world. Workers go to the job hungry because they don’t have money for a meal.

“Are we entering an AI-driven boom time like an out-of-control Monopoly game? Or will we be too broke to eat breakfast?”

There’s a mismatch here between two visions of the emerging economy.

So which one is real? Are we entering an AI-driven boom time like an out-of-control Monopoly game? Or will we be too broke to eat breakfast?

Let’s try to answer this question—because a lot is at stake in getting the answer right.

I see signs of economic turmoil everywhere in the real world:

Starbucks sales are down and they are closing 100 stores.

KFC and Pizza Hut sales are down in the US.

Dozens of other restaurant chains are closing locations.

Las Vegas tourism is down sharply and visitors describe it as a ghost town.

In fact, the entire hotel and hospitality industry is shrinking.

There are now a half million more homes for sale in the US than home buyers.

Credit card debt is rising—and is now back at its all-time high.

US unemployment is the highest it’s been since the pandemic.

The jobs data was so bad that the person compiling the numbers got fired!

Companies are getting desperate, and they can’t hide it. A friend reports that Pizza Hut sent him a promotion on Tuesday morning, offering a two dollar pizza. He wondered how they could possibly make money on this deal.

And then that same day he got a notice from competitor Papa John’s, also promising a two buck pizza.

Two bucks for a pizza? Really?

This is how businesses respond when customers totally disappear. They will do anything to bring them back. Otherwise they have to shut down.

And this is a reality untouched by promises of an AI boom time. It’s everywhere in the real world where flesh-and-blood people live and work.

I don’t give stock tips at The Honest Broker. I am not a financial adviser. But I will tell you what I see:

(1) Half of the gains in the stock market are due to just five stocks.

This is ominous. In previous market crashes this kind of narrowing has been a warning sign.

In times of genuine prosperity, many people benefit, and there’s plenty of good news to share. That’s not the case right now, not at all.

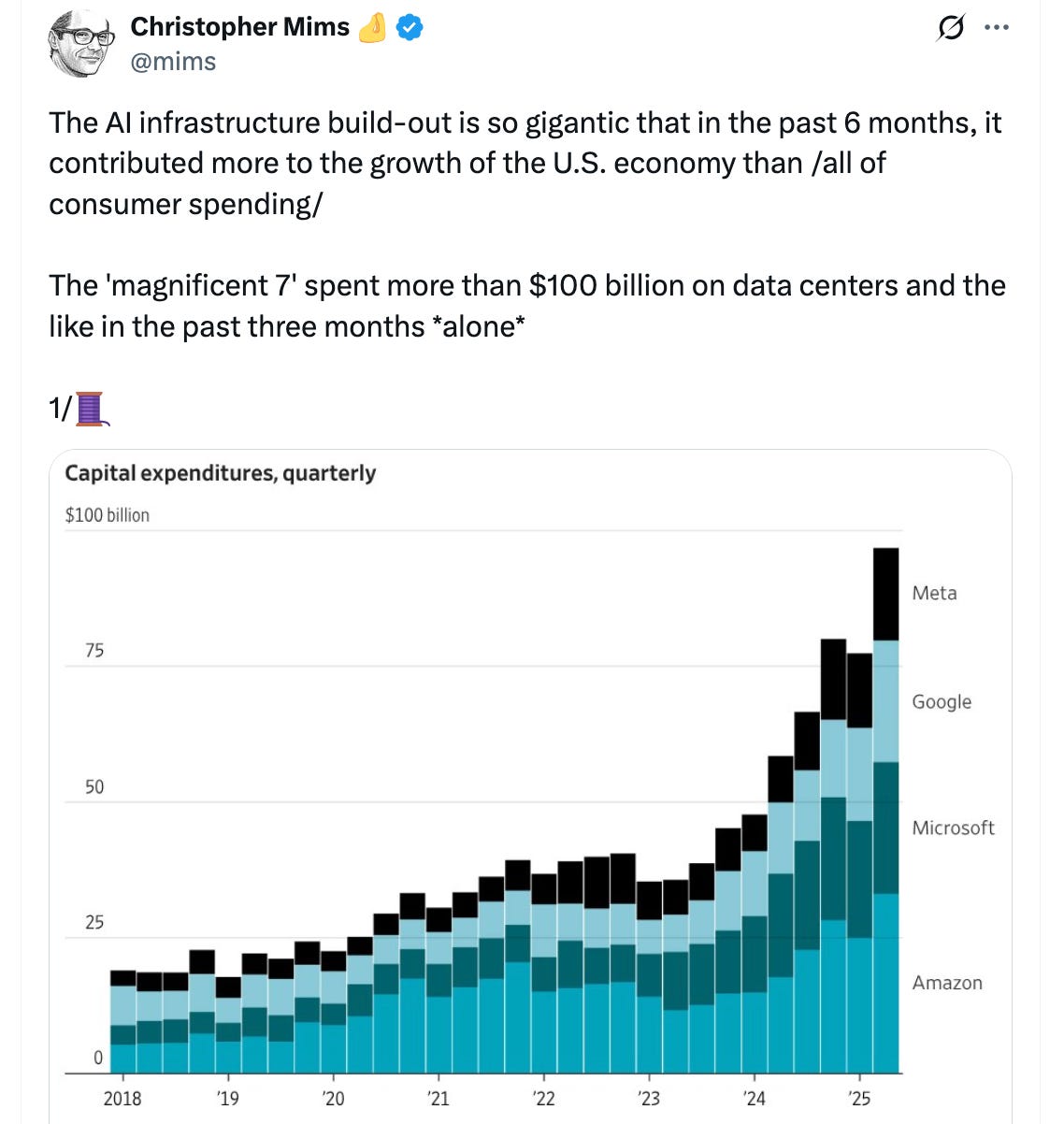

(2) These companies are betting everything on the buildout of AI data centers.

AI buildout is contributing more to measured economic growth than all of consumer spending.

I want you look long and hard at this chart, and consider the implications.

Consider that this is all driven by four CEOs, motivated perhaps by ego and rivalry. And despite all this spending on AI, these companies haven’t created any meaningful stand-alone businesses from the technology.

Meta and Google still make almost all of their money from selling ads. They will try to bundle AI into this activity, but the benefits are unclear. Ads made by AI are widely mocked at present.

Microsoft is also trying to bundle AI into healthy existing businesses—but irritating customers in the process.

I could argue that the spending in the recent quarter is unsustainable. But the situation is much worse than that—because many stock market investors are extrapolating from this trend, and anticipating future growth at the same rate.

This, my friends, is what a bubble top looks like.

What’s even worse is that these are business-to-business transactions, and must eventually be paid for (directly or indirectly) by actual consumers. Without actual demand from end users willing to cover the cost of data center buildout, these investments can’t be justified.

(3) There’s no indication that consumers are willing to pay for this enormous infrastructure.

Fewer than 1% of ChatGPT users are paid business accounts. That total is no larger than the number of paid Substack subscribers (but what a difference in company valuation!).

In fact, most of ChatGPT’s traffic disappears when students go on summer vacation.

That tells you how wide the chasm is between reality and the crazy claims of AI fanboys—but many of them (I bet) are also reluctant to pay for AI. Even software developers, previously among the most enthusiastic cheerleaders for AI, now have grown skeptical—positive sentiment in this cohort has dropped 10% in just the last year.

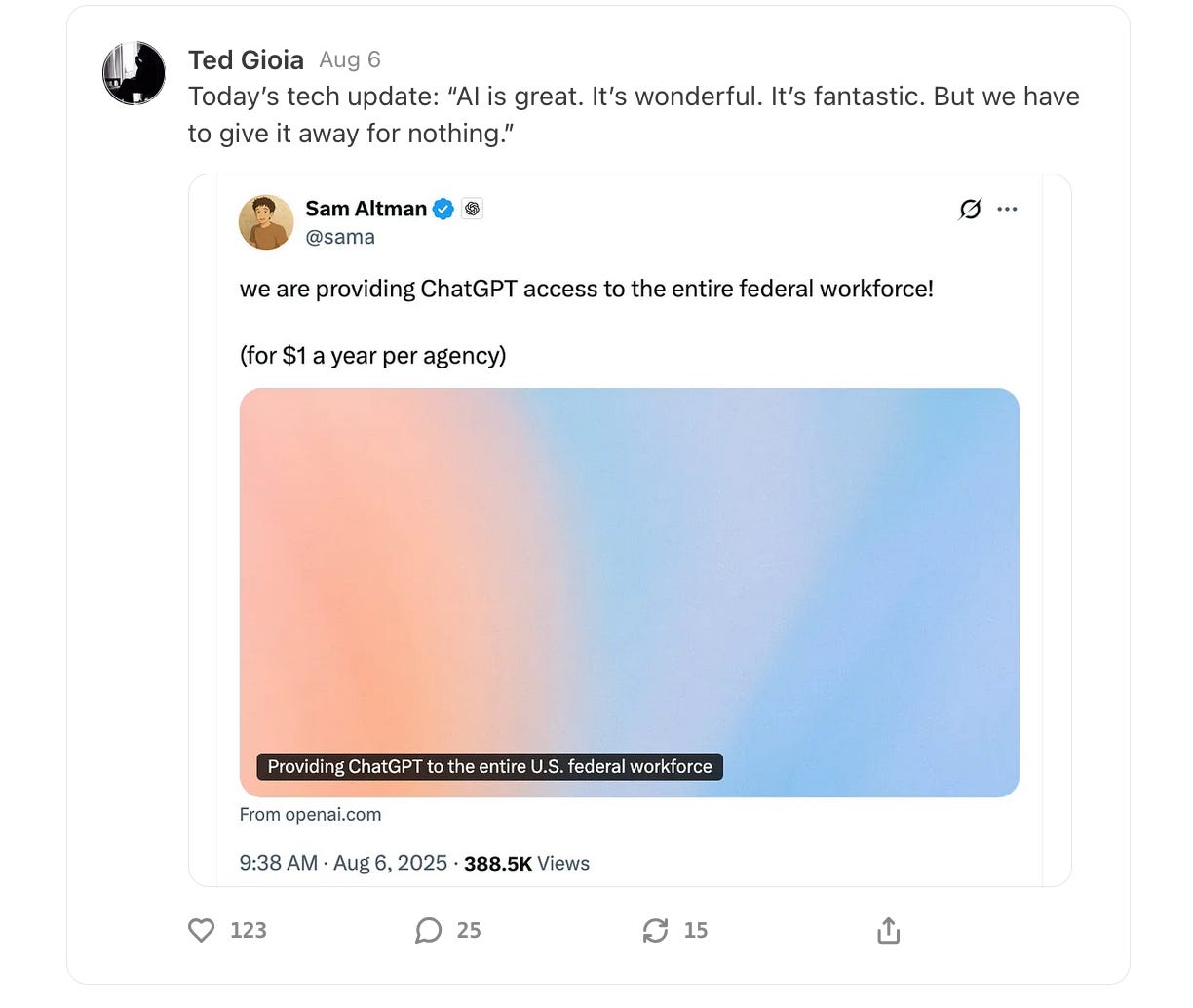

The tech simply doesn’t live up to the hype. The more people deal with it, the less they like it. That’s why AI companies must give it away (or bundle it into an already successful product) in order to gain any reasonable usage.

So everywhere I go online, companies are touting free AI. That’s funny. It doesn’t fit the narrative of a transformative technology.

Simon Owens make a reasonable observation. If AI is so smart, why don’t the people who own the AI companies just use the super intelligence to enrich themselves. Giving it away is idiocy, and even selling it is highly questionable.

I hear horror stories about the opposite happening. CEOs who have tried AI and seen how poorly it performs are reluctant to speak about it in public—they look like dupes. But surveys show that 75% of the projects have failed to meet expectations.

(4) The reality is that nobody can afford the proposed AI data center buildout.

According to new data from Morgan Stanley, the total buildout will cost almost $3 trillion over the next three years, and the AI companies will only have cash to cover half of this expenditure. Somebody else has to come up with another $1.5 trillion—and it’s not clear where that money will be found.

(5) And there are all sorts of other warning signs—energy usage, water consumption, etc.

The energy grid can’t support this growth in AI data centers. There’s no industry on the planet with such an ugly environmental impact. Meta and Google will need to get into the nuclear power business just to keep the bots running.

All this looks like a bubble. It smells like a bubble. It quacks like a bubble.

I will remind you that Mark Zuckerberg’s last spending spree was focused on virtual reality. That turned into a total bust. And I predicted it here from the outset.

But before the VR market collapsed, Zuckerberg convinced Apple and Microsoft to throw money away at it. That’s not surprising—the tech world is built on imitation and group think. (Has everybody forgotten the dotcom bubble?)

The same thing is happening now. Four billionaires play their own version of high stakes Monopoly, while the rest of us try to bunker down on Baltic Avenue.

But even four billionaires can’t change reality. Yes, they are spending like drunken sailors, but that just makes the bubble bigger. It can’t stop it from bursting. The crazy level of investment only makes the eventual fallout all the worse.

How much longer can it last? Maybe a few weeks or a few months or a few quarters. Billionaires often throw good money after bad. But the whole economy is fragile—or beyond fragile—right now. And that’s the bigger reality.

By any reasonable measure, the current trend is unsustainable. And there’s one thing I know about unsustainable trends—there’s a day of reckoning, and it’s not a happy one for the people who caused it. But, even sadder, they take down a lot of others with them when the bubble bursts.

Thanks for making this post more widely available. When I started on Substack, I was using AI-gen images. Your work and that of others persuaded me to stop.

Agree completely that this is a hopeless unsustainable bubble. There may be small portions of current LLM investment that produces products people will freely pay for, but the magnitude of proposed spending cannot happen, and this will trash the stock market at some point.

But take another step back. This is not an MBA-type business/financial problem anymore. The real question is what happen after the stock market decline, and that is a political problem. As you and your readers understand after the dot-com crash and the 2008 crisis, there was widespread popular realization that the financial world had screwed over the rest of society royally, but none of the people who most directly “caused” those crises were punished, and the broader bad behavior quickly resumed.

An AI crash would be a much bigger deal politically. Both political parties are totally beholden to not only “big tech” but the broader “number go up” ideology where the artificial inflation of the equities of a handful of companies is falsely equated with widespread economic growth. Every one of Trump’s signature programs (huge tax cuts, huge spending on immigration and defense) falls apart if those big tech stock prices collapse, along with the idea that he could serve both his big donors while protecting non-wealthy MAGA supporters. National Democrats are equally devoted to big tech and unlimited defense spending, and if the numbers stop going up the wealth of the Democrats core PMC supporters will crash.

Financial/donor interests controlled both parties in 2008 but issues like CDOs could be isolated and portrayed as one-time anomalies that didn’t fundamentally challeng “number go up” thinking. Housing was still a “real” thing but “AI” isn’t and a 2026 bust would create an existential challenge to “number go up”

If the Dow Jones collapses absolutely every political faction with any real power will fight tooth and nail to deny it is happening, to shovel massive taxpayer funds to help prop up Wall Street and Big Tech and to furiously oppose anyone demanding real changes or demanding that those factions pay a price for the destruction they unleashed.

There are thousands of people like you who have been pointing out the growing problems for years, but they have zero voice within either party and after decades in the wilderness there is no realistic possibility they could suddenly organize. Big Tech has a well developed playbook for strengthening their already massive dominance. See “Super PAC aims to drown out AI critics in midterms, with $100M and counting” (Washington Post 26 Aug).

“Might the AI stock bubble burst?” is no longer a critical question. “What will all the political factions that were cheerleaders for Number-Go-Up do after it bursts” is a much more important question